PAYMENT PROCESSING 101

Whether you're a brand new business or have been accepting credit cards for years, we can save you money.

Whether you’re a brand-new business or you have been accepting credit cards for years, we offer the most competitive rates. Partnered with Bay State Merchant Services, with currently 25 years in the industry, together we processes over 600 million dollars in transactions annually. This gives us the ability to back our locked-in rate guarantee (with no cancellation fees) for the life of the relationship with our customers. Triangle Merchant Services is committed to providing you, our customer, with honest merchant processing at very competitive rates, and we will always show you the results in a side-by-side comparison.

two ways to process payments

1. Dual Pricing (cash or Credit pricing)

Credit card companies have held merchants hostage for years; however, the rules have changed.

Now you can pass credit card fees on to credit using customers and recoup 90% or more of Visa, MasterCard, and Discover merchant processing fees. Example: $20 ticket = $20.80 total

Your business will dramatically reduce operating costs, allowing you to increase your profit margin. The “Save 90%” program allows you an out-of-the-box solution, with minimal training and setup.

“Gas stations in many states have been offering discounts to cash customers for years, but most merchants felt hamstrung by consumer protection laws and card brand rules that discouraged the practice.

That all changed in Congress with the Durbin Amendment to the Dodd-Frank Act which, in addition to requiring the capping of debit interchange, it also gave merchants the go-ahead to offer discounts or other incentives to customers using certain payment methods (like cash or check).”

– Patti Murphy, The Green Sheet, September 2018

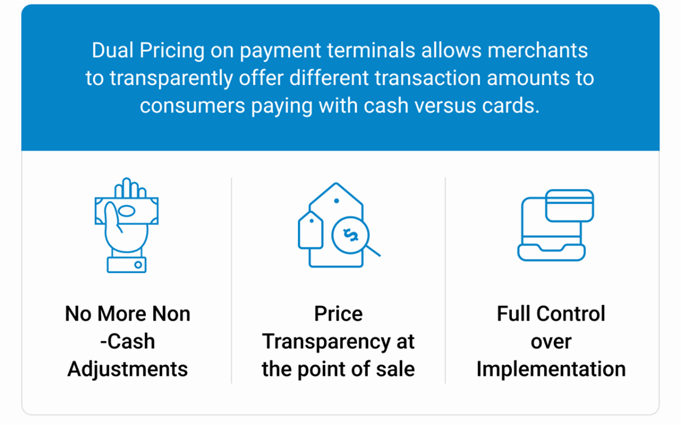

What is dual pricing credit card processing?

Understanding dual pricing

Credit card processing is an essential part of doing business for most merchants, be it online or brick-and-mortar stores. Perhaps, you’ve heard of dual pricing credit card processing or “no-fees processing” and wondered what it is all about.

Well, in simple terms, dual pricing refers to a pricing model where merchants can offer customers two payment options, one for cash paying customers and one for those using a payment card. A “customer assistance fee” is applied to transactions using a payment card, thus giving cash paying customers a discounted price.

Why do merchants use dual pricing?

There are a couple primary reasons more and more merchants are choosing to implement a dual pricing credit card processing model. The first reason is to help offset the costs associated with accepting payment cards and increase profit margins.

“Once they implement our model, many of our clients have been able to cut their cost of accepting payment cards by over 90%.” Says Ian Tortorella, Principal for Triangle Merchant Services.

The second most common reason why merchants choose to implement a dual pricing credit card processing program is to reward and increase the amount of their cash customers.

The benefits of dual pricing

A dual pricing credit card processing model is a cost-saving strategy for merchants who accept cards as payment. This type of processing allows merchants to add an additional fee for customers who choose to pay with a credit or debit card, allowing them to recoup up to 90% of the merchant processing fees they would normally pay. The “customer assistance fee” is applied either as a percentage of the transaction amount or set flat rate fee, depending on the policy set by the merchant.

This type of pricing helps merchants save money while still offering customers an easy way to checkout with their payment cards. The additional fees can be used to cover the costs associated with accepting and processing card payments which can include interchange, assessment, and processor fees. By implementing dual pricing credit card processing model, these costs are shifted from the business onto the customer, allowing businesses to significantly reduce their overall expenses related to card payments.

Another benefit of dual pricing is that it can help protect businesses from losses that can occur due to fraudulent transactions charged on compromised cards or those made without authorization from the cardholder. By increasing the amount of cash paying customers, and decreasing the amount of payment card transactions, you will also reduce your chances of illegitimate chargebacks and fraudulent transactions.

Understanding dual pricing credit card processing is essential for merchants who rely on credit card transactions to process payments. Dual pricing allows you to offer all payment types, reduce your merchant processing fees, increase the amount of cash paying customers and limit liability and losses. Merchants should, therefore, be aware of the benefits of a dual pricing credit card processing model to determine if it would be a good fit for their business needs.

For more information or a complimentary product demonstration, please contact Triangle Merchant Services today and we will connect you with your local Certified Payment Professional.

Slash the cost of accepting payment cards by over 90% with dual pricing.

2. Traditional Processing

Traditional Processing is where you, the merchant, pays a percentage on every transaction based off of the credit card your customer uses. (Interchange +). We offer the most competitive rates whether you’re a brand-new business or you have been accepting credit cards for years. Every merchant service provider claims to offer the lowest processing rate. However, after switching with them your processing rate will eventually increase, and if you decide to switch processors you’ll typically pay a cancellation fee. Alternatively, we at Triangle Merchant Services will never raise your rate throughout the life of our relationship with you.

With Triangle Merchant Services there are NO CONTRACTS, NO CANCELLATION FEES, and NO LEASE AGREEMENTS for POS units.

If at any time during the term of your current Merchant Processing Agreement with us, you receive a legitimate written offer, including all applicable rates, fees, and charges that will result in you paying less per month for your credit card processing, we will meet or beat that offer. It’s that simple.

Triangle Merchant Services is committed to helping our clients' businesses succeed & grow.

What is an Interchange Rate?

The term interchange rate refers to a fee that a merchant must pay with every credit and debit card transaction. Rates are set by payment card issuing companies in exchange for accepting the credit risk and handling charges inherent in these transactions. Interchange rates are set by financial companies and revised periodically. Rates vary based on the network used and are often a percentage of the transaction amount, a flat fee, or a combination of both. Transaction types also determine the rate that is charged, so the rate for a supermarket purchase is often lower than airline transactions.

KEY TAKEAWAYS

- Interchange rates are a per-swipe fee charged by banks to merchants using credit or debit cards.

- Fees are charged by payment processing companies like Visa, Mastercard, Discover, and American Express.

- The interchange rate is normally a small percentage of the transaction amount and is currently higher for credit card transactions compared to those made with debit cards.

- Interchange is justified as a buffer against the credit risk of consumers who borrow to make these purchases that financial companies become exposed to.

- Interchange fees are divided up between merchants’ banks and the credit card issuing company.

Understanding an Interchange Rate

Fees are an integral part of the revenue generated by banks and financial service companies. These charges range from administration fees to account fees. They can be levied on clients and nonclients alike. Some institutions also collect fees from merchants whenever they execute transactions that are used to make purchases with credit or debit cards. These are called interchange fees or swipe fees.

The amount of an interchange fee depends on an interchange rate. They are charged as a flat fee, a percentage of the transaction amount, or a combination of both. They are often vary based on the merchant and type of transaction that takes place. The type of card also affects the interchange rate, which means they are different for debit, credit, and prepaid cards. Money collected goes from the merchant is divvied up between the merchant services company (which is also known as the payment processor) and the customer’s card issuer.

Almost any entity that accepts payment cards incurs these fees so retailers aren’t the only ones that are affected. This means that even charities that accept donations via debit or credit must pay interchange fees.

How Interchange Rates Are Determined

Interchange rates are set by credit card companies such as Visa, MasterCard, Discover, and American Express. With Visa and MasterCard, the rate is set on a semiannual basis, usually in April and then in October. Other credit card companies might set their rates annually.

Each credit card company sets its interchange rates, but the fees are paid by every merchant bank or institution that conducts a transaction with a cardholding consumer. In addition to the interchange rate, credit card processing companies may include another fee that is passed along to retailers as part of their processing fees.

Transactional Factors

Different cards offered by the same card company may be assigned different interchange rates. As noted above, the rate is usually expressed as a percentage of the transaction. It may also be a flat fee or a combination of both the percentage and flat rate. And there are a number of factors that can affect the fee that is charged.

Another factor that can influence the interchange rate is the type of transaction being executed. The way the transaction is completed can also influence the rate that is charged. For instance:

Interchange Fee Regulation

Financial services companies are some of the most heavily regulated entities in the economy and the world. So it should come as no surprise that interchange fees and rates also fall under the purview of financial regulators, notably under the Durbin Amendment, which is part of the Dodd-Frank Wall Street Reform and Consumer Protection Act.

The amendment, named after U.S. Sen. Richard J. Durbin, limits transaction fees imposed upon merchants by debit card issuers. It proposed restrictions to interchange fees, which averaged $0.44 per transaction based on 1% to 3% of the transaction amount, to $0.12 per transaction for banks with $10 billion or more in assets.

It was based on the belief that interchange fees were not reasonable and proportional to card issuers’ costs. When the bill became law in 2010, interchange fees were capped at $0.21 per transaction plus 5% of the transaction amount. Some banks implemented new fees and eliminated free services in an attempt to offset their interchange fee revenue losses.

Credit Card Interchange Rates

The majority of interchange fees for credit cards are charged by the world’s two largest credit card companies: Visa and Mastercard. Discover also charges fees similar to those levied by Visa and Mastercard. As noted above, each company charges different fees for different cards. So debit cards that bear the Visa, Mastercard, and Discover name typically come with lower rates. High-end Visa, Mastercard, and Discover credit cards, such as point, cashback, and elite cards (gold and platinum cards) come with higher fees.

American Express, which offers credit and charge cards, also imposes fees on merchants. Rather than referring to them as interchange rates, the company calls them discount rates. Discount rates work the same way as interchange rates. Fees are often a combination of a percentage of the transaction as well as a flat fee.